The case underscores the growing scrutiny of corporate debt defaults and the increasing willingness of banks to pursue aggressive legal measures to recover funds.

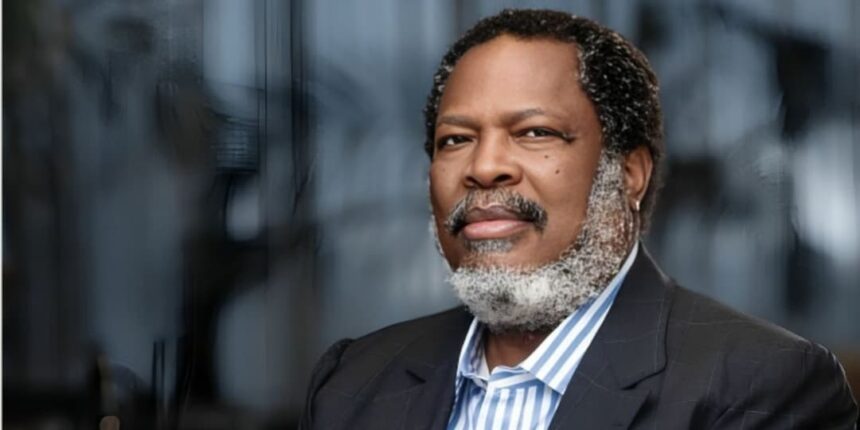

Media mogul Nduka Obaigbena

Media mogul Nduka Obaigbena

Segun Adeyemi

A Federal High Court has issued Mareva injunctions freezing assets and accounts linked to General Hydrocarbons Limited, its affiliates, and media mogul Nduka Obaigbena over an alleged $225.8 million debt.

The court’s decision follows a legal battle initiated by First Bank of Nigeria Ltd and FBNQuest Trustees Ltd, both subsidiaries of FBN Holdings Plc, seeking to recover outstanding loan facilities.

According to court documents obtained, the plaintiffs claim that General Hydrocarbons, an oil and gas company owned by Obaigbena, defaulted on the loan repayment as of September 30, 2024.

The company, which operates Oil Mining Lease (OML) 120, is now subject to severe financial restrictions.

Court Order and Financial Restrictions

A judge uses a gavel in a courtroom.Naruecha Jenthaisong/Getty Images

The Mareva injunctions restrain major commercial banks, including Guaranty Trust Bank, Access Bank, Zenith Bank, and First Bank, from releasing funds or facilitating transactions involving the defendants.

Digital platforms such as Paystack and Piggyvest were also directed to freeze accounts associated with the embattled company and its affiliates.

“An order of Mareva injunction restraining all commercial banks in Nigeria, including Guaranty Trust Bank Limited, Access Bank Plc, Citibank Nigeria Limited, Carbon Bank, Ecobank Nigeria Plc, Fidelity Bank Plc, First Bank of Nigeria Limited, First City Monument Bank Plc, Globus Bank, Heritage Bank Limited, Jaiz Bank, Keystone Bank Limited, Opay Digital Services Limited, PalmPay Limited, Paystack Payments Limited, Piggyvest, Momo Payment Service Bank Limited, Polaris Bank Limited, Providus Bank, Stanbic IBTC Bank Nigeria Limited, Standard Chartered Bank, Sterling Bank Plc, SunTrust Bank Limited, Union Bank of Nigeria Plc, United Bank for Africa Plc, Unity Bank Plc, Wema Bank Plc, Zenith Bank Plc, and all other financial institutions operating in Nigeria, from releasing or dealing with any funds or assets due to the GHL up to the sum of $225,802,379.69,” the injunction states.

In addition, companies involved in oil block OML 120 operations were directed to submit production and revenue records. Proceeds were diverted to the plaintiffs’ account pending further hearings.

Allegations of fund diversion

A stock image shows a gavel, keyboard, and dollar notes.designer491/Getty Images

According to the court filings, the loans were initially secured with crude oil stocks, insurance policies, and receivables.

However, the plaintiffs allege that the funds were misused for personal expenditures, including luxury real estate acquisitions and private jet operations.

Sources familiar with the case disclosed that the financial institution sought court intervention to prevent the defendants from depleting assets before a final ruling.

The injunctions also extend to individual directors of General Hydrocarbons, barring them from selling or transferring personal assets within Nigeria.

Implications for the financial and media landscape

The legal action against General Hydrocarbons and Obaigbena could have broad implications for corporate governance and financial oversight in Nigeria.

The case underscores the growing scrutiny of corporate debt defaults and the increasing willingness of banks to pursue aggressive legal measures to recover funds.

Market analysts noted that the development immediately impacted FBN Holdings’ stock, which fell 1.27% to close at N31.05 on Thursday.

Investors are closely monitoring the proceedings, with concerns about potential ripple effects on the financial services and media industries.

What happens next?

Legal experts suggest that the court’s decision to impose a Mareva injunction indicates the severity of the allegations and the need to prevent asset dissipation.

The case is ongoing, and further hearings are expected to clarify whether the frozen assets will be liquidated to settle the outstanding debt.

Observers anticipate that the outcome could shape future legal approaches to corporate debt disputes in Nigeria.

If upheld, the court’s order may serve as a precedent for financial institutions seeking to secure claims against delinquent borrowers.

As the legal battle unfolds, stakeholders in Nigeria’s financial and energy sectors await the court’s final ruling, which could determine the fate of General Hydrocarbons and its influential owner, Nduka Obaigbena.