Emefiele sacked Ogunlesi and 4 other things you didn’t know

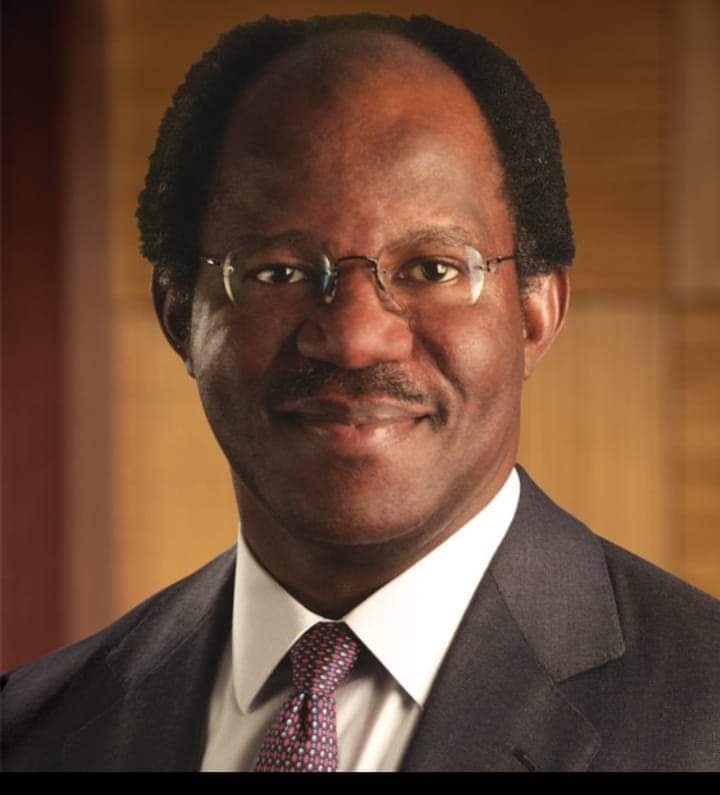

Adebayo Ogunlesi, a Nigerian-born lawyer, investment banker, and businessman, has carved a path from being a law graduate to becoming a global infrastructure powerhouse in the finance industry.

Despite being dismissed by Godwin Emefiele, the former governor of the Central Bank of Nigeria, from the position of chairman at the African Finance Corporation, he has now been acquired by the world’s largest asset manager for $12.5 billion.

Here are 5 things you didn’t know about Ogunlesi:

Emefiele sacked him

According to a knowledge source, Ogunlesi previously held the position of chairman at the African Finance Corporation, an entity focused on financing infrastructure projects in Africa, during Lamido Sanusi’s term as the governor of the Central Bank of Nigeria.

However, he was dismissed by Godwin Emefiele upon assuming office.

The source noted that Ogunlesi, although hesitant, eventually accepted the decision, preferring not to get involved in political matters and avoiding the accommodation of personal interests.

“I did say to Sanusi that Bayo would not accept any political interference in the board nor accept any personal interests being accommodated. It must be said that Lamido Sanusi did honour the assurances that he gave on governance and non-interference. Lamido Sanusi was removed as governor of CBN, and Godwin Emefiele became Central Bank Governor. I can recall discussing AFC with Emefiele,” the source said.

“Anyway, Emefiele fires Bayo as Chairman. He didn’t even have the courtesy of informing him. He replaces him not with an infrastructure expert but with Joseph Nnanna, his deputy governor and a regulator. Today, Emefiele is battling to stay out of jail. Bayo’s infrastructure company has been bought by the largest asset manager in the world,” the source added.

He is a sports lover

Ogunlesi is a passionate cricket and Tottenham Hotspur fan who makes time for them at critical moments, according to the Financial Times (FT).

Wike summons emergency security council meeting

According to FT, a director of Topgolf Callaway Brands said that he had become an “atrocious golfer” since knee surgery. But Kenneth Chenault, former CEO of American Express, who plays regularly with him, said this self-deprecation minimises his “competitive fire.”

He does not like publicity

Ogunlesi, a Nigerian-born financier who pioneered a $ 1 trillion sector, one of the fastest-growing segments of money management is a publicity-shy person.

Despite his prominent board positions, including the Goldman Sachs, in an interview, he was asked why he has remained so private, he said, “I don’t need to read about myself,” he said. “I know enough about myself and who I am.”

He is a family man who holds his wife in high esteem

Ogunlesi a father of two said he owes his career switch to his wife according to an interview he had with Financial Times.

Torn between a banking career and a gnawing dissatisfaction, Ogunlesi found the answer at home. His wife’s “kick in the behind,” as described in a Financial Times interview, led him to quit at 52 and embrace a new path as an investor.

“In 2005, then as a top banker at Credit Suisse, he was summoned to Omaha, Nebraska, by the energy arm of Warren Buffett’s Berkshire Hathaway to study a large takeover. It was the kind of call most financiers dream of, but Ogunlesi complained to his wife: “I really don’t want to go.”

He said his wife offered an ultimatum: “Either you decide you like your job and you want to keep doing it. Or, if you decide you don’t, go find something else. But please don’t think you can spend the next five years moaning.”

He will have his first boss after 18 years

Ogunlesi, the co-founder and CEO of GIP is set to join BlackRock’s board and global executive committee, however, in this new role, he will be working under Larry Fink, the founder and CEO of BlackRock, marking his first experience with a boss in 18 years.

However in the interview, he said Fink, a friend since both worked at First Boston, has downplayed the potential for conflict: “Larry said to me: ‘You will be on the board of directors, you will be my boss’. I think we have mutually assured destruction.”