The student loan scheme that is set to kick off soon is unique and different from the students’ loan scheme in other parts of the world, including the developed countries. To start with, Nigeria’s students loan is interest-free! The sum is static with a range of repayment options that are tied to a borrower’s income. The structure of the loan repayment is very friendly and flexible.

The beneficiaries will get a two-year “grace period” after completing the one-year National Youth Service before they are expected to commence repayment of the loan. The beneficiary begins repayment only when he or she has started earning income. The baseline repayment amount is 10% of the monthly net pay of the beneficiary (in the case of an employee) or 10% of monthly income or profit of the beneficiary (in the case of a self-employed) until the loan is liquidated provided the 10% income of the beneficiary in question does not exceed the total loan disbursed to the beneficiary.

There is also an option of a one-off repayment or an opportunity to indicate the particular percentage model you want for those in private business. Beneficiaries who can not find employment within the grace period of two years will have to periodically report their employment status to the Student Loan board. Of course, there are modalities in place linked to the beneficiary’s BVN to ensure this claim is verifiable.

There is also a possibility of waivers. Beneficiaries of the student loan confirmed to be dead, terminally ill, and incapable of earning a living through work will be granted waivers. This will also be highly ring-fenced and supported by the most credible of proofs to guard against abuse. This student loan scheme is perpetual in nature, which means there is a termination date for the scheme. Funding sources have been made available in the establishment Act with the Education Tax Fund collected by the FIRS being the most prominent source of funding.

The student loan scheme will certainly help to increase the number of Nigerians who are able to attend and graduate from public tertiary institutions or skill/vocational training institutions. This will also eventually help in improving the quality of education and ultimately increasing the employability of our fresh graduates. There are no negatives that one can associate with the student loan scheme.

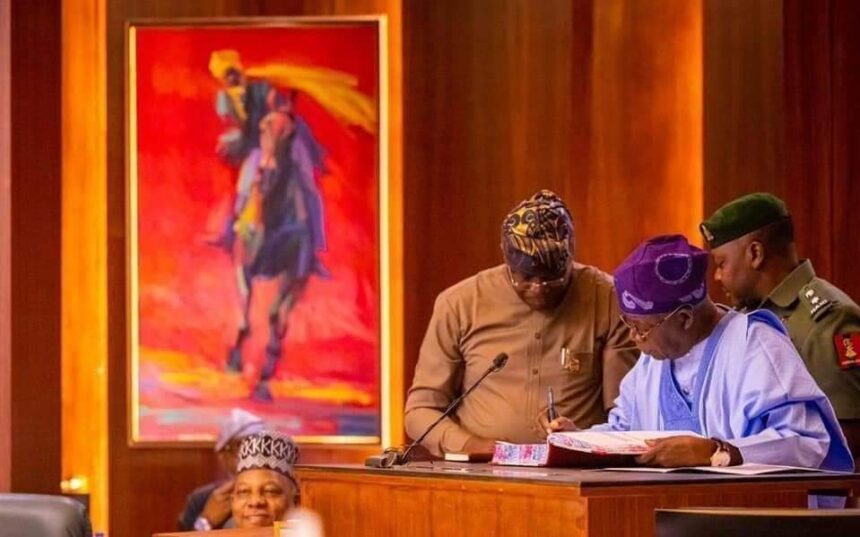

This is one programme with the capacity to unlock the enormous possibilities locked in our population before now due to the absence of universal access to quality tertiary education and skills development. This is a forward leap for our nation and a Renewed Hope promise kept by Mr. President.

History will be kind to Chief of Staff and former Speaker of the House of Representatives, RT Hon Femi Gbajabiamila, for sponsoring this all-important bill while in the House of Representatives.

It will be kinder to President Tinubu for sticking to a vision he has had long before now.

Now, let the educational revolution begin!